GUIDANCE FOR ANNUAL FILING FORM AOC-4

The Annual Filing Form AOC-4 is a mandatory form that all companies incorporated in India are required to file with the Registrar of Companies (ROC). The form contains details of the company’s financial statements, board of directors, and other important information.

Here are some key points to keep in mind when filling out the AOC-4 form:

1. Annual General Meeting Date

As per Section 96 of the Companies Act, 2013, the annual general meeting of a company (other than a one-person company) must be held within 6 months of the close of the financial year, or 9 months in the case of the first annual general meeting of the company.

When filling out Point No. 7(b) in Part A of Segment I of the annual filing form AOC-4, you must consider the first clause of Section 96 of the Companies Act, 2013. The annual filing form asks for the due date and date of the annual general meeting.

It is important to note that the due date of the annual general meeting cannot exceed the time limit specified in Section 96 of the Companies Act, 2013. The date of the annual general meeting must also be on or before the due date.

It is also important that the date of the annual general meeting is not a national holiday. This is expressly stated in the Companies Act, 2013.

Can the annual general meeting be held on a Sunday?

Yes, as long as it is not a national holiday. The following are national holidays that are notified by the government:

2nd October

26th January

15th August

You may also refer to Section 96 of the Companies Act, 2013 for reference.

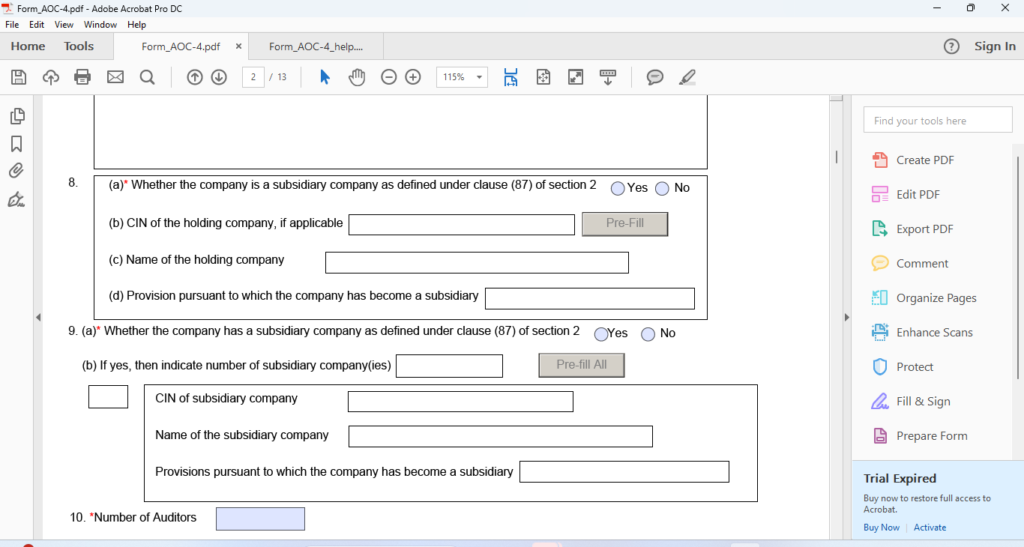

2. Subsidiary and Holding Company Details

The annual filing form AOC-4 requires the details of the holding company of the company and its subsidiary companies.

Ie. Refer to the screenshot of the same as attached below for ready reference

Whether the company is a subsidiary company as defined under clause (87) of section

This question is asked at Point-08 in Part A of Segment I of the annual filing form AOC-4. In this column, the company needs to fill in the details of its holding company.

To answer this question, you can refer to the capital sheet of the financial statement. If any other entity (other than an individual) holds more than 50% of the shares in the company, then that entity is the holding company of the company.

Whether the company has a subsidiary company as defined under clause (87) of section

This question asks for details of the company’s subsidiaries at Point-09 in Part A of Segment I of the annual filing form AOC-4.

You can easily check the company’s financial statement to fill in these details. Refer to the investments made by the company. If the company itself holds more than 50% in any other company, then that company would be the subsidiary of the company.

3. TYPE OF INDUSTRY

At Point 11(b) in Part A of Segment I of the Annual Filing AOC-4 form, the industry details of the company are required. If the type of industry is other than Banking, Power, Insurance, or NBFC, then select Commercial and Industrial (C&I).

4. WHETHER SCHEDULE III OF THE COMPANIES ACT, 2013 IS APPLICABLE

If the type of company is commercial & industrial or NBFC, then select the ‘Yes’ option only.

5. WHETHER CONSOLIDATED FINANCIAL STATEMENTS REQUIRED OR NOT ???

This information is required at Point 12 in Segment 1 of the AOC-4 form. If the company has subsidiaries or associates, it is required to file consolidated financial statements. So, be careful while filling out the details at this point.

If you select “No” instead of “Yes”, then the company will not be able to file the AOC-4 CFS form. Therefore, consolidated financial statements will not be filed for the financial year.

6. RENT EXPENSE DETAILS

The AOC-4 form specifies a place for rent expense of the company. Therefore, review the Profit and Loss Statement of the company and if the company has paid any rent during the year, the amount should be mentioned in the Rent Paid column of Segment II of the annual filing AOC-4 form.

The above-mentioned section of the Annual Filing AOC-4 form specifically provides a field for the rent expense. However, this field is often inadvertently ignored by companies. It is important to review the Profit and Loss Statement of the company and if the company has made rent expenses, then Point No. 6 of Part III of Segment II of the Annual Filing Form AOC-4 needs to be filled.

7. GROSS VALUE OF TRANSACTION WITH RELATED PARTIES AS PER AS-18

The captioned details are very confusing for many of us. It is asked at two places in the Annual filing AOC-4 form at segment-I and segment–II.

The confusion is whether the outstanding amount or the transaction value that arose during the year should be filled in. Here is the solution:

If you read the heading of PART –III of Segment –I,FINANCIAL PARAMETERS – BALANCE SHEET ITEMS (AMOUNT IN RUPEES) AS ON FINANCIAL YEAR END DATE, It mentions the “as on the end date of the financial year”.so the data in this part should be filled with the closing balance of the transaction.

If you read the heading of PART –III of Segment -II ,FINANCIAL PARAMETERS – PROFIT AND LOSS ACCOUNT ITEMS (AMOUNT IN RUPEES) DURING THE REPORTING PERIOD , the heading explicitly asks for the details of “during the reporting period”. This means that the value of the transaction that occurred during the reporting period should be filled in this section.,.

Or simply put, the difference between the opening and closing balance of related party transactions should be filled in.

8.Segment III: Reporting of Corporate Social Responsibility (CSR)

This segment of the Annual Filing AOC-4 form is dedicated to Corporate Social Responsibility (CSR) details. Details of turnover and net worth of the company need to be filled in this section. The confusing part is which year’s details need to be mentioned here.

If we read Section 135 of the Companies Act, 2013, the section mentions the immediately preceding financial year. The applicability of Corporate Social Responsibility (CSR) is determined based on the previous year’s turnover, profit, and net worth of the company.

Therefore, the Detail of Turnover, and net worth of the company immediately preceding the financial year should be filled in.

9. Common Issues in Segment IV of the AOC-4 Form

This section of the annual filing AOC-4 form is dedicated to the details of Related Party Transactions (RPTs). RPTs are defined under Section 188 of the Companies Act, 2013. If a company enters into RPTs, it is required to file AOC-2 to disclose these transactions.

Segment IV of the AOC-4 form requires the details of RPTs in the same format as defined by the Act in AOC-2. The company is mandatorily required to file the details of RPTs in AOC-2 format. Therefore, this section should correspond with the AOC-2 form for the financial year.

10. COMMON MISTAKE IN THE SEGMENT V OF THE AOC-4 FORM

The Segment V of the annual filing AOC-4 form requires details of the auditor’s report. However, the very first point,

(A) In the case of a Government Company, Whether Comptroller and Auditor-General of India (CAG of India) Commented Upon or Supplemented the Audit Report Under Section 143 of the Companies Act, 2013?

is only applicable to government companies. The common mistake is that companies of all types select the option “NO” for this point. It is important to note that this point only requires details for government companies. If the company is not a government company, there is no need to select any option.

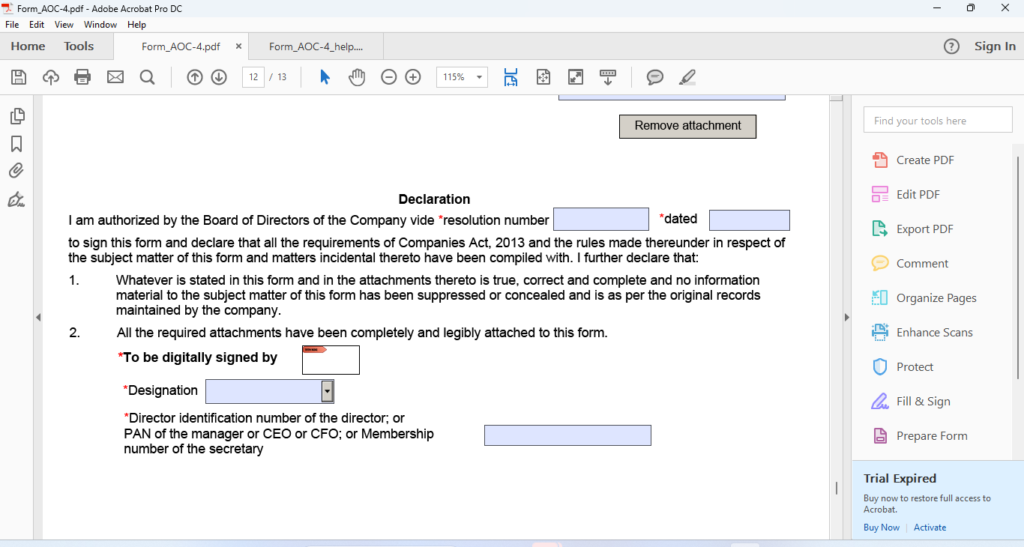

11. DECLARATION PART OF THE ANNUAL FILING FORM:

Kindly have a look as the screenshot is attached for ready reference:

The declaration part must be filled by the authority who is affixing their digital signature to certify the form. The Annual Filing Form AOC-4 specifically requires the details of the board resolution date and resolution number that authorized the signatory of the Annual Filing AOC-4 form.

The declaration part of the AOC-4 form is a very important part of the form. It is a declaration by the person who is affixing their digital signature to the form that they have verified the information in the form and that the information is true and correct.

The board resolution date and resolution number are also very important. They are the details of the board resolution that authorized the signatory to file the AOC-4 form. This resolution is important because it shows that the company has authorized the signatory to file the form and that the information in the form is accurate.

By following these guidelines, you can ensure that your AOC-4 form is filled out correctly and that your company complies with all applicable regulations.

Leave a Reply